TAMPA, Fla., June 06, 2019 (GLOBE NEWSWIRE) -- HCI Group, Inc. (NYSE: HCI), a leading provider of property and casualty insurance in Florida, has completed its catastrophic reinsurance program for the 2019-2020 contract year, which runs from June 1, 2019 through May 31, 2020.

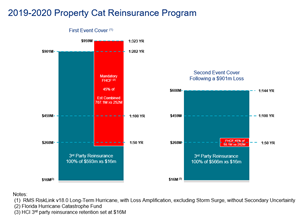

HCI purchases insurance called reinsurance from other insurance companies and the Florida Hurricane Catastrophe Fund, known as FHCF, to cover policyholder losses associated with hurricanes and other catastrophes. The 2019-2020 reinsurance program provides coverage up to approximately $901 million for catastrophic losses in a single event, excluding flood losses. According to catastrophe models approved by the Florida Office of Insurance Regulation, this coverage is sufficient to cover the company’s probable maximum loss resulting from a 1 in 282-year storm based on projected exposure at September 30, 2019. The total limit for all occurrences, excluding flood losses, is $1.477 billion.

Net reinsurance premiums, excluding flood for the contract year that began June 1, 2019 are expected to be $112 million, assuming no losses occur during that period. Expected growth from TypTap Insurance Company, HCI’s technology driven insurance subsidiary, could increase net reinsurance premiums at the exposure true up on September 30, 2019.

Based on assumed growth and including reinsurance premiums for flood, HCI’s total ceded reinsurance premiums for the 2019-2020 contract year are estimated to be $124 million.

“We received strong support from our reinsurers based on our data transparency, insourced business model, and internally developed claims software,” said Paresh Patel, HCI’s chief executive officer. “In addition, we purchased a similar tower structure, maintained our 45% FHCF election, and reduced our absolute spend compared with last year’s program while keeping our first and second event retentions unchanged.”

The company released a chart describing its reinsurance structure:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ecc563b7-a4a6-44df-9636-6123a3e80425

About HCI Group, Inc.

HCI Group, Inc. owns subsidiaries engaged in diverse, yet complementary business activities. The most important of these business activities are insurance, the development of insurance-related information technology, or “InsurTech,” and the ownership and development of real estate. HCI’s largest subsidiary, Homeowners Choice Property & Casualty Insurance Company, Inc., is a leading provider of homeowners’ insurance in Florida. HCI also has a rapidly growing, technology-driven insurance subsidiary called TypTap Insurance Company which provides homeowners’ and flood insurance primarily in Florida. TypTap’s operations are based in large part on information technology developed by HCI’s software subsidiary, Exzeo USA, Inc. HCI’s real estate subsidiary, Greenleaf Capital, owns and operates multiple properties in Florida, including office buildings and waterfront properties.

The company's common shares trade on the New York Stock Exchange under the ticker symbol "HCI" and are included in the Russell 2000 and S&P SmallCap 600 Index. HCI Group, Inc. regularly publishes financial and other information in the Investor Information section of the company’s website. For more information about HCI Group and its subsidiaries, visit www.hcigroup.com.

Forward-Looking Statements

This news release may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such as "anticipate," "estimate," "expect," "intend," "plan," "confident," "prospects" and "project" and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. There can be no assurance, for example, that all reinsurers will fulfil their obligations to the company in the event of a catastrophe. Some of these risks and uncertainties are identified in the company's filings with the Securities and Exchange Commission. Should any risks or uncertainties develop into actual events, these developments could have material adverse effects on the company's business, financial condition and results of operations. HCI Group, Inc. disclaims all obligations to update any forward-looking statements.

Company Contact:

Kevin Mitchell, Senior Vice President of Investor Relations

HCI Group, Inc.

Tel (813) 405-3603

kmitchell@hcigroup.com

Investor Relations Contact:

Matt Glover or Najim Mostamand, CFA

Gateway Investor Relations

Tel (949) 574-3860

HCI@gatewayir.com