TORONTO, ON / ACCESSWIRE / February 18, 2021 / Nighthawk Gold Corp. ("Nighthawk" or the "Company") (TSX:NHK)(OTCQX:MIMZF) is pleased to announce that it has entered into a binding option agreement (the "Option Agreement"), with Geomark Exploration Ltd., (‘Geomark") a wholly-owned subsidiary of Pine Cliff Energy Ltd., to acquire a 100% undivided leasehold interest in four (4) contiguous mining leases (the "Kim & Cass Property", a total of 7,588 acres (31km2) that incorporate the historic Kim and Cass zones), immediately adjacent to Nighthawk's Indin Lake Gold Property, Northwest Territories, Canada.

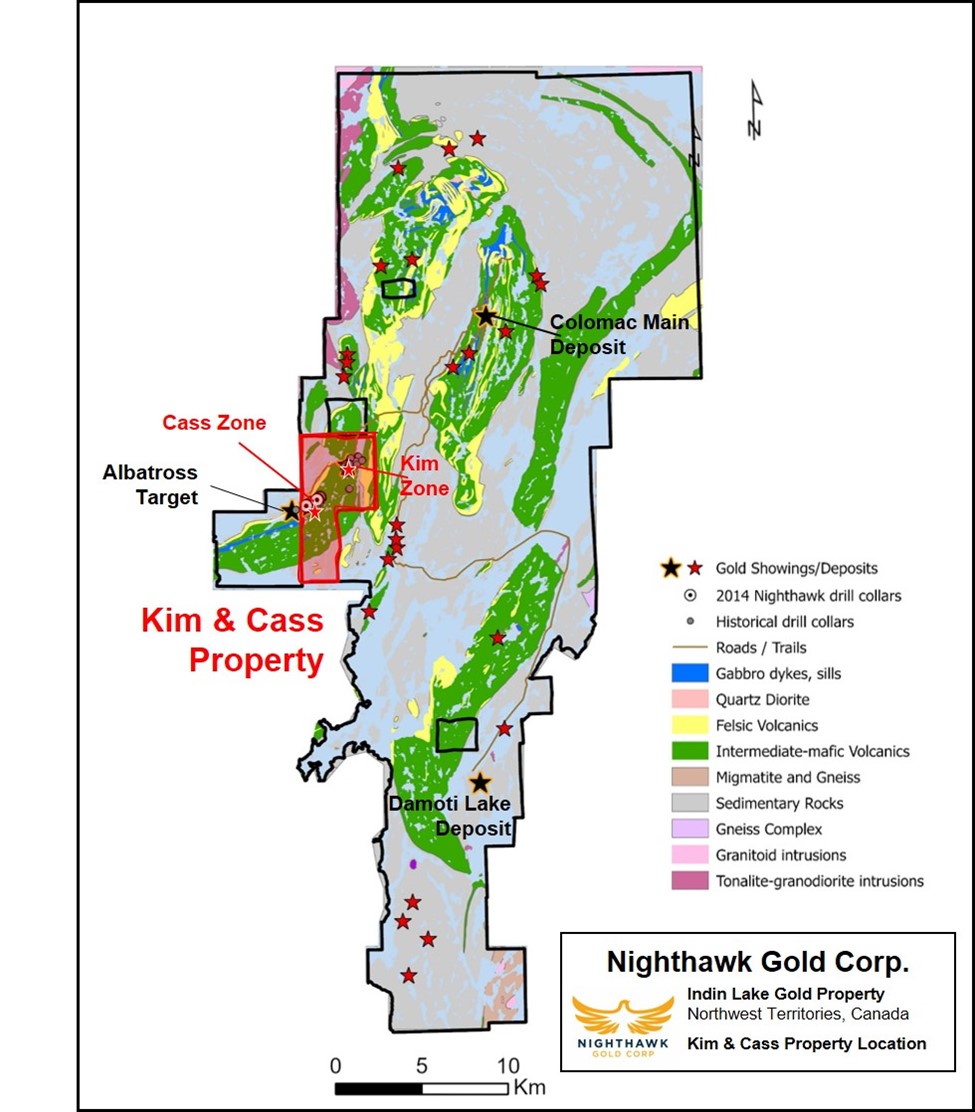

The Kim & Cass Property is an integral part of Nighthawk's consolidation strategy and represents an important piece of ownership that provides contiguity to the main claim group with the Albatross claim block (Figure 1). Nighthawk believes that the historic Kim and Cass zones and the 4km-long Albatross trend (with surface samples returning up to 20.60 grams per tonne gold ("g/t", "Au")) enhances the potential of identifying near-surface mineralization within 15km of the Colomac Main Deposit ("Colomac"). The apparent higher-grade nature of historical drilling suggests that with further exploration work, that there may be the possibility for above-average, near-surface deposits in line with the Company's near-term objectives.

Nighthawk's President & CEO, Keyvan Salehi commented, "We are encouraged by the high-grade nature encountered by historic drilling at both Kim and Cass, especially given that drilling was constrained mainly within 75 metres of surface, leaving significant room for expansion at depth. The zones are immediately east of our Albatross target which has returned surface values of up to 20.6 g/t Au over a 4km strike length. Together, they represent quality targets that fit our immediate strategy of looking for near-surface, higher-grade opportunities proximal to Colomac. Additional work contemplated in this area will be discussed as part of the 2021 exploration program, the details of which will be released once all preparatory work has been completed in the coming weeks."

Highlights:

- Option to acquire 100% interest in the Kim & Cass Property which incorporates the historic Kim and Cass zones.

- Historic non-compliant resource outlined 2,857,093 tonnes at an average grade of 2.66 g/t Au for 245,311 ounces of gold (see Nighthawk press release dated December 18, 2013)1.

- Over 32,000 metres of historic drilling with the majority located within 75 metres of surface.

- Nighthawk's 2014 drilling program successfully extended the Cass mineralized corridor by an additional 700 metres, where it remains open at depth and along strike.

- Estimated prior to the implementation of NI 43-101 Standards, previous work defined historic gold resource estimates that have yet to be fully evaluated, and therefore should not be relied upon. A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or reserves. Furthermore, the Company is not treating the historical estimates as current mineral resources or reserves as defined by NI 43-101 as the Company is not able to assess the work required to upgrade to a compliant resource at this time.

Details of Option Agreement

As part of the terms of the Option Agreement, Nighthawk has agreed to pay aggregate consideration of $1.1 million and grant a 2.5% net smelter return ("NSR") royalty. In addition, Nighthawk shall have the right, at any time, to purchase up to 100% of the Geomark NSR for up to $2.5 million, thereby reducing the Geomark NSR to zero if the full 100% is purchased.

Payment Schedule:

- Upon execution of the Option Agreement - $400,000 (which has been satisfied in full by the issuance of 340,000 common shares of Nighthawk);

- On or before February 17, 2022 - $350,000 in any proportion of common shares or cash, at Nighthawk's full discretion; and

- On or before February 17, 2023 - $350,000 in any proportion of common shares or cash, at Nighthawk's full discretion.

Kim & Cass Deposits

The Kim & Cass Property was originally optioned in December 2013, and in 2014, Nighthawk carried out a small exploration program to test the northeast and southwest extensions of the Cass Deposit (a total of 2,926 metres were completed, see highlights of drilling in the table below). In December 2015, due to limited capital resources at the time, the Company announced its decision to let the option expire as per the terms of the agreement (at the time the Company had a market capitalization of $4.4 million, see Nighthawk press release dated December 29, 2015, which is available at www.sedar.com). Historical drilling outlined the deposit over a strike length of 360 metres and to a depth of 210 metres. Results from Nighthawk's 2014 drilling program extended the mineralized corridor an additional 700 meters, opening up a vast region for infill drilling, which is needed to confirm continuity of the mineralized zone. In addition, hole CM14-04 crossed the mineralized zone 375 metres vertically and returned 38.90 g/t Au over 4.4 meters, demonstrating its continuity at depth (see table below).

The Kim & Cass Property and the related Kim and Cass zones are being assessed as part of the Company's 2021 exploration program to build out exploration targets that support the Company's 2-year goals and objectives, and are considered prospective given their high-grade nature, continuity of mineralization, and potential for growth given the limited exploration work completed to date.

Cass Zone - Highlights of Nighthawk 2014 Drilling2

|

Deposit |

Hole ID |

Interval (Metres) |

Core Length |

Gold Grade |

|

|

From |

To |

(Metres) |

(g/t) |

||

|

Cass Deposit |

CM14-02 |

121.00 |

172.00 |

51.00 |

2.25 |

|

CM14-04 |

140.00 |

141.70 |

1.70 |

19.36 |

|

|

406.90 |

411.30 |

4.40 |

38.90 |

||

|

CM14-06 |

143.00 |

169.00 |

26.00 |

2.86 |

|

|

CM14-06B |

112.80 |

149.00 |

36.20 |

2.89 |

|

|

including |

118.00 |

140.00 |

22.00 |

4.24 |

|

|

CM14-12 |

52.60 |

56.00 |

3.40 |

5.84 |

|

|

BHID |

Easting |

Northing |

Elevation |

EOH |

Azimuth |

DIP |

|

CM14-02 |

581184.2 |

7131038 |

342.66 |

402.01 |

55 |

-65 |

|

CM14-04 |

581112.5 |

7131001 |

332.79 |

450.01 |

55 |

-65 |

|

CM14-06 |

581026 |

7131015 |

334.17 |

273.01 |

100 |

-60 |

|

CM14-06B |

581026 |

7131015 |

334.17 |

234.01 |

100 |

-45 |

|

CM14-12 |

581653 |

7131401 |

374.07 |

116.01 |

100 |

-45 |

2. See Nighthawk press releases dated October 27 and December 3, 2014, which are available at www.sedar.com.

Kim and Cass Zones - Highlights of Historical Drilling3

|

Deposit |

Hole ID |

Interval (Metres) |

Core Length |

Gold Grade |

|

|

From |

To |

(Metres) |

(g/t) |

||

|

Cass Deposit |

C86-18 |

18.85 |

22.40 |

14.55 |

3.42 |

|

38.70 |

65.35 |

26.25 |

6.53 |

||

|

C86-27 |

48.10 |

89.50 |

41.40 |

3.35 |

|

|

C86-34 |

97.30 |

134.15 |

36.85 |

5.67 |

|

|

C87-16 |

106.20 |

186.90 |

80.70 |

4.53 |

|

|

C95-05 |

122.00 |

170.00 |

48.00 |

4.15 |

|

|

C95-06 |

153.00 |

205.00 |

52.00 |

5.10 |

|

|

C95-09 |

82.00 |

105.00 |

23.00 |

7.43 |

|

|

Kim Deposit |

MZ84-01 |

25.30 |

36.50 |

11.20 |

8.37 |

|

MZ84-02 |

32.90 |

50.65 |

17.75 |

8.16 |

|

|

MZ84-04 |

25.10 |

48.95 |

23.85 |

3.35 |

|

|

MZ85-66 |

9.50 |

38.10 |

28.60 |

4.78 |

|

|

MZ85-68 |

50.20 |

75.50 |

25.30 |

2.88 |

|

|

BHID |

Easting |

Northing |

Elevation |

EOH |

Azimuth |

DIP |

|

C86-18 |

581345.3 |

7131101 |

344.9 |

90 |

280 |

-45 |

|

C86-27 |

581387.3 |

7131106 |

340.2 |

143 |

280 |

-45 |

|

C86-34 |

581412.8 |

7131100 |

339.4 |

169.7 |

283 |

-43 |

|

C87-16 |

581347.2 |

7131061 |

338.7 |

221.1 |

283 |

-50 |

|

C95-05 |

581158 |

7131102 |

353.2 |

203.4 |

77.5 |

-45 |

|

C95-06 |

581157 |

7131102 |

353 |

285.6 |

84.2 |

-62.3 |

|

C95-09 |

581188 |

7131096 |

353.2 |

163.1 |

90.5 |

-45 |

|

MZ84-01 |

583660 |

7133661 |

288.8 |

75 |

116 |

-50 |

|

MZ84-02 |

583612 |

7133574 |

290 |

74.2 |

116 |

-50 |

|

MZ84-04 |

583585 |

7133478 |

292.17 |

55 |

116 |

-50 |

|

MZ85-66 |

583601 |

7133495 |

289.95 |

98.4 |

116 |

-46 |

|

MZ85-68 |

583575 |

7133509 |

295.27 |

121 |

116 |

-50 |

*Lengths are reported as core lengths, true widths are unknown at this time.

3. These results are historic in nature and have not been verified by the Company (see Nighthawk press releases dated March 26, April 10, April 26, and July 29, 2014, which are available at www.sedar.com).

Figure 1. Plan View of Indin Lake Gold Property - Kim & Cass Property

Figure 2. Plan View of the Kim & Cass Zones (Historical and NHK 2014 drill collar locations)

About Nighthawk

Nighthawk is a Canadian-based gold exploration company with 100% ownership of a district-scale land position within the Indin Lake Greenstone Belt, located approximately 200 km north of Yellowknife, Northwest Territories, Canada. Within this largely underexplored Archean gold camp, the Company has identified a number of high-priority targets within large regional deformation zones that are pregnant with gold mineralization and are known to host significant deposits which warrant additional exploration and follow-up, all centered around a growing multi-million-ounce deposit. The main goals and objectives over the next 12-24 months will be to carry out aggressive exploration to support resource expansion opportunities as well as to foster new discoveries that support the global resource base.

The Company has an experienced and dedicated team with a track record of successfully advancing projects and is well funded and supported to complete its goals and objectives.

Qualified Person

Richard Roy P.Geo., V.P. Exploration of Nighthawk, who is the "Qualified Person" as defined by NI 43-101 for this project, has reviewed and approved of the technical disclosure contained in this news release. Mr. Roy verified the data contained here in by reviewing available historical reports, logs, assay results and maps.

FOR FURTHER INFORMATION PLEASE CONTACT:

NIGHTHAWK GOLD CORP.

Tel: 1-647-794-4313; Email: info@nighthawkgold.com

Website: www.nighthawkgold.com

Keyvan Salehi

President & CEO

Michael Leskovec

CFO

Suzette N Ramcharan

VP, Corporate Development

The Toronto Stock Exchange has neither reviewed nor accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, information with respect to the Company's ability to meet the requirements of the Option Agreement, including anniversary payment amounts and the timing thereof; the Company's continued exploration programs and the ability to advance targets and the timing and results thereof; the mineral resource estimates; and access to available capital to complete all work necessary to achieve the Company's stated goals and objectives. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved".

Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nighthawk to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Nighthawk's annual information form for the year ended December 31, 2019, available on www.sedar.com. Although Nighthawk has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Nighthawk does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Nighthawk Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/630443/Nighthawk-Enters-Into-Option-Agreement-To-Acquire-the-Kim-Cass-Property-Located-15KM-Southwest-of-Colomac